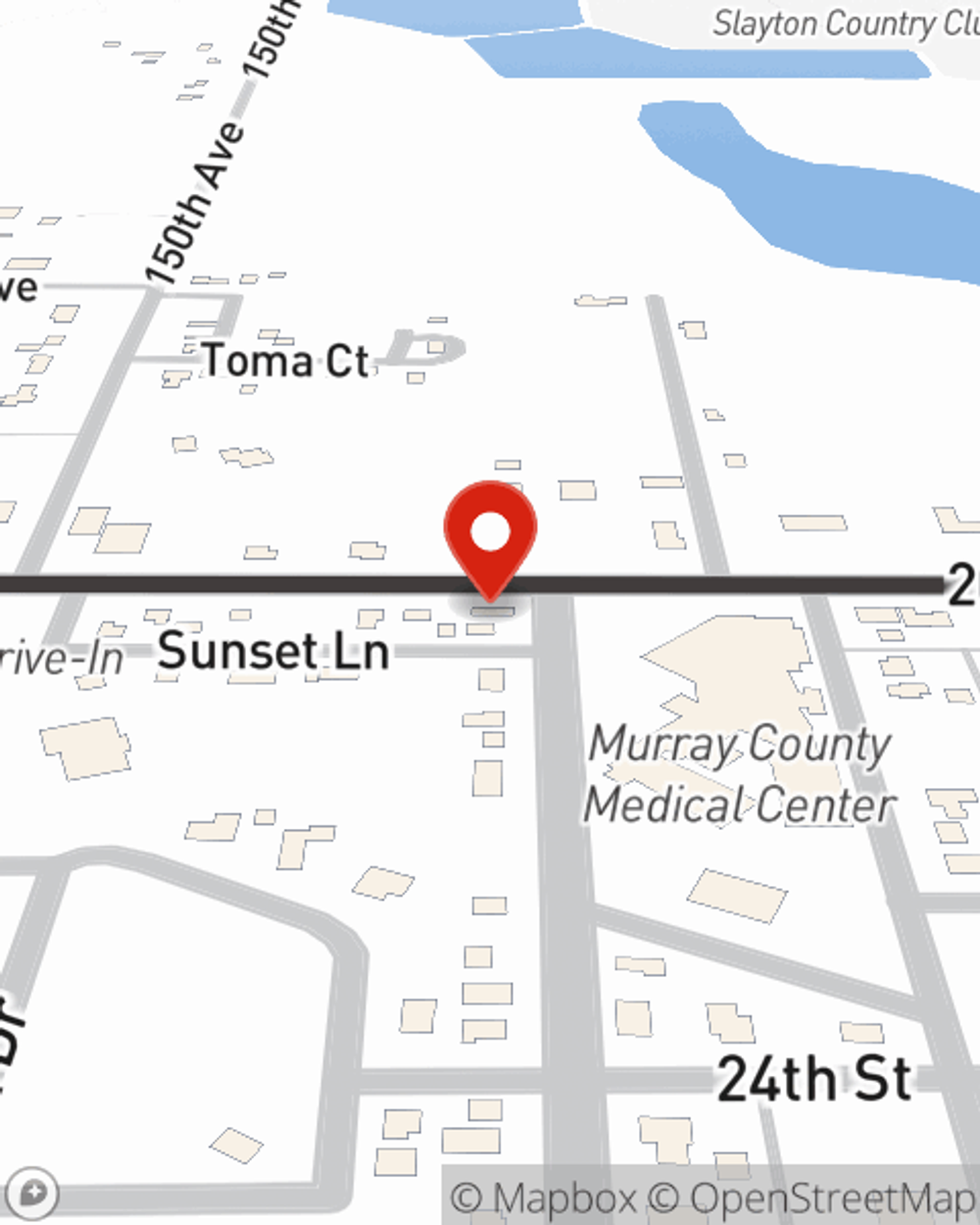

Business Insurance in and around Slayton

Slayton! Look no further for small business insurance.

Cover all the bases for your small business

Insure The Business You've Built.

You may be feeling overwhelmed with running your small business and that you have to handle it all on your own. State Farm agent Kim Holm, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

Slayton! Look no further for small business insurance.

Cover all the bases for your small business

Customizable Coverage For Your Business

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are an optometrist or a home cleaning service or you own an art gallery or a window treatment store. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Kim Holm. Kim Holm is the person who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

It's time to reach out to State Farm agent Kim Holm. You'll quickly uncover why State Farm is one of the leaders in small business insurance.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Kim Holm

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.